You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Schertz looks to be Gone!

- Thread starter Birdfriend72

- Start date

dpdoughbird06

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 1,023

Who’s the 1% that stays in Terre Haute? There’s no “there” there.If he cannot get it done this year, then I believe he is not the guy for the new future. Building a culture and bringing in freshmen and developing is a roadmap probably for the past. Every year now is a rebuild/reload year. Now is probably more of a system, talent evaluation, and recruiting climate. Especially in the middle mid majors. Most players if they develop into something good will go get the 6 figure payout. One and done. Move up and out. This is the future. If the player spreads the money out over a couple years they can even lessen the tax implications. And yes if you play for a Florida team you have no state income tax. The angles are so much different now. Lastly, what did the Indiana State fans expect? Guy works his whole career to make a living and he gets a chance to cash in not just for him but for the future of his family and they are mad about it? Give 99% of them the same deal and they leave southwestern Indiana in a heartbeat.

HinsonWho’s the 1% that stays in Terre Haute? There’s no “there” there.

Hamdonger

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 6,675

At this rate, within a few years PowerBall winners will go broke.

I have heard the PG Larry is staying at Indy State - rumors have SLU giving Schertz $2 million in NIL money to use. Supposedly 4 players transferring to SLU - Avila is still a question mark due to large offers on the table, needs to make a decision. Time will tell, what really happens.

B

BirdGrad2011

Guest

Conwell might entertain bigger offers than SLU. Hes certainly earned high level P6 looks.

DougSutton

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 450

For sure, this is where I wish university leaders could observe athletic programs and the role they play with the university as a whole through the lens of a business and thus, make strategic decisions based on the bigger picture.At this rate, within a few years PowerBall winners will go broke.

There are plenty of examples including Loyola (Chicago), Gonzaga, I'm sure Indiana State this last season, Colorado (football) where their athletic programs (basketball on the first 3 examples plus Colorado) incredibly influenced and increased visibility for the university that impacts student applications, enrollment, ticket sales, donations, booster engagement and also provides significant revenue to the community via ticket sales, hotels, restaurants, etc.

I know the university itself can't directly invest in NIL but if there was a way around this (which I'm sure there are indirect ways to make it happen) if Illinois State could find $2 million budget to get a starting 5 that could generate the same success and ripple effect as what Indiana State has had, it would be an easy decision to make to find the money to pay players.

Even if you only consider increased attendance, an additional 5,000 fans coming to each game on average with 16 home games per year at $25 per ticket would generate an additional $2 million in revenue that goes straight to the bottom line. So you could get a new starting 5 and pay them $400,000 each per season which is more than Antonio Reaves got at Kentucky). That takes nothing else into consideration regarding downstream ripple effects. If it were me, and you could take all factors into consideration, it's an incredibly easy decision to make.

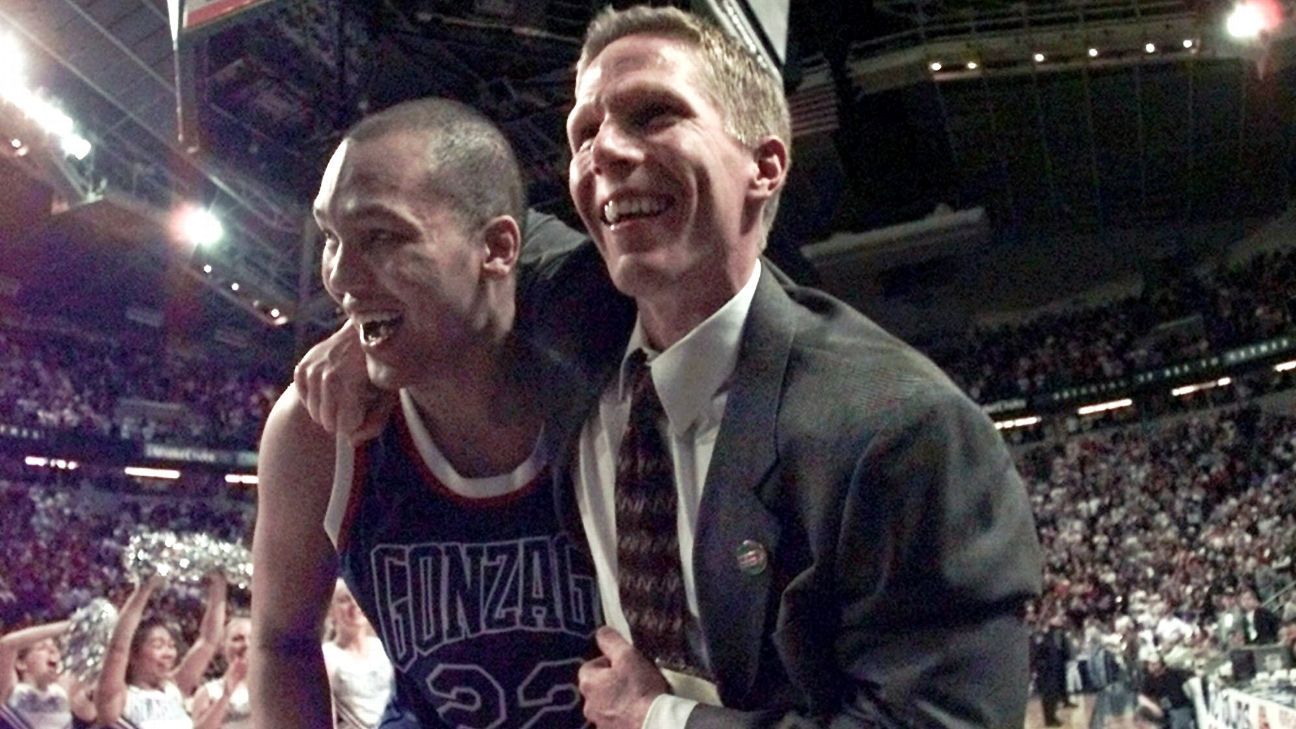

How the basketball program helped Gonzaga University flourish

Before Gonzaga embarked on its original Cinderella run in 1999, the university was hurting financially. Now the Bulldogs and the school are just fine.

Just a couple farmers I know over there. Kind of hard to move the farm ground.Who’s the 1% that stays in Terre Haute? There’s no “there” there.

In today's world of higher education, the tail wags the dog. Schools like Gonzaga are way ahead of the curve here. No one really cares about the academics at Gonzaga, but everyone knows about their bball team. With declining numbers of incoming students, the cost of attending college and on line courses, the competition has never been more heated. Sports can mean the difference between sinking and swimming and if we don't understand this, it might be too late by the time we do.

Hamdonger

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 6,675

I realize you're just riffing, Doug...but it makes me shiver to think we're suggesting 2M for a starting 5 at Illinois State Teachers University.I know the university itself can't directly invest in NIL but if there was a way around this (which I'm sure there are indirect ways to make it happen) if Illinois State could find $2 million budget to get a starting 5 that could generate the same success and ripple effect as what Indiana State has had, it would be an easy decision to make to find the money to pay plplayers.

I'm not that old, all things considered...but MAN do I feel old trying to wrap my head around that statement.

Makes me want to forget all this and go surf naked off the San Diego coast.

Last edited:

DougSutton

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 450

I realize you're just riffing, Doug...but it makes me shiver to think we're suggesting 2M for a starting 5 at Illinois State Teachers University.

I'm not that old, all things considered...but MAN do I feel old trying to wrap my head around that statement.

Makes me want to forget all this and go surf naked off the San Diego coast.

I'm partially riffing but also tend to look at topics like this through the lens of business. I can only imagine that any university must have some type of operating budget relating to marketing that directly correlates to student enrollment and other factors. I'd be shocked if they didn't track basic KPIs to see what investments generated what ROI.

As the Gonzaga article mentioned above, and many other data that I've seen over the years, success in revenue generating college sports athletic programs generate absolute downstream revenues to the university and community they live in.

So if I'm tasked with being in charge of budgeting with my primary fiduciary responsibility being what is best overall for Illinois State Teachers University, and I was convinced by looking at the data that an investment of $2 million per year (or more) for a starting 5 would generate a direct ROI in ticket sales along plus a significant increase in university media exposure, student enrollment and other revenue, it would be a no brainer decision and dollar for dollar would generate great ROI than possibly any other investment I could make.

IRS has been looking very closely at schools/donors the past 12 months to make sure money earmarked as donations to the university isn't being redirected to NIL.

$2 million NIL really has to come from donors/fans directly to the collective. They can't transfer university donations or funds to NIL otherwise.

$2 million NIL really has to come from donors/fans directly to the collective. They can't transfer university donations or funds to NIL otherwise.

Redbird222

Well-known member

- Joined

- Jul 18, 2017

- Messages

- 5,470

The indirect revenue would increaseI'm partially riffing but also tend to look at topics like this through the lens of business. I can only imagine that any university must have some type of operating budget relating to marketing that directly correlates to student enrollment and other factors. I'd be shocked if they didn't track basic KPIs to see what investments generated what ROI.

As the Gonzaga article mentioned above, and many other data that I've seen over the years, success in revenue generating college sports athletic programs generate absolute downstream revenues to the university and community they live in.

So if I'm tasked with being in charge of budgeting with my primary fiduciary responsibility being what is best overall for Illinois State Teachers University, and I was convinced by looking at the data that an investment of $2 million per year (or more) for a starting 5 would generate a direct ROI in ticket sales along plus a significant increase in university media exposure, student enrollment and other revenue, it would be a no brainer decision and dollar for dollar would generate great ROI than possibly any other investment I could make.

Donations

Student enrollment

Corporate sponsorships/advertising

All would go up with better teams

DougSutton

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 450

IRS has been looking very closely at schools/donors the past 12 months to make sure money earmarked as donations to the university isn't being redirected to NIL.

$2 million NIL really has to come from donors/fans directly to the collective. They can't transfer university donations or funds to NIL otherwise.

This definitely presents an interesting dilemma. My understanding is donors can't tax deduct their contributions to an NIL collective in the same way they could to a non profit/school. Businesses "can" deduct NIL contributions as long as it can be documented they are receiving real value for their sponsorship (ie. photo shoots, branding, videos, etc.)

Perhaps the laws will continue to change and be challenged in court. My sense is this is just a first step in what will be a continually evolving legal structure.

SgtHulka

Well-known member

- Joined

- Jul 17, 2017

- Messages

- 7,041

Not a givenThe indirect revenue would increase

Donations

Student enrollment

Corporate sponsorships/advertising

All would go up with better teams

Layoffs begin as UA navigates big budget shortfall

TUCSON -- (KVOA) University of Arizona leaders say a round layoffs is underway as the the university continues a financial restructuring to deal with a budget deficit north of $160

I brought this up earlier somewhere, and was half kidding, but...could NIL money be baked into student fees? If the university added another $50-100 for each student, that's an extra 1-2 mil right there.

Dunno if that's feasible or even legal. It's certainly pathetic and off-putting in a way, basically asking students to pay other students, the majority of which would have no clue where it's going. But on the other hand, it wouldn't surprise me as an option if it were possible.

Part of me still can't believe I just typed that and this is what college athletics has come to.

Dunno if that's feasible or even legal. It's certainly pathetic and off-putting in a way, basically asking students to pay other students, the majority of which would have no clue where it's going. But on the other hand, it wouldn't surprise me as an option if it were possible.

Part of me still can't believe I just typed that and this is what college athletics has come to.